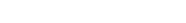

M7 Advisors provides proven executives with many decades of experience to assist you in making investments, acquiring or divesting a company, or companies, vertical integration or reorganizations, and Strategic Marketing in the Energy business anywhere in the world.

ABOUT M7ADVISORS

Our team has spent the greater part of our lives as senior executives, CEO’s, Chairmen and directors of private and public major oil companies, service companies, worked closely with senior debt and equity banking providers, with finance and legal specialists. M7 also has access to a network of similar veterans that can be brought into the loop allowing a depth of advice given to you unparalleled by any firm in the industry.

VALUE PROPOSITION

Deals are done in the energy industry everyday by institutional investors, public and private companies, private equity firms and venture capital investors who have little or no intimate knowledge of the inner workings of the industry – either oil & gas or offshore renewables sources. Value creation and relatively short timing (less than a decade) tend to be typical investor hold objectives and success will be very dependent on the cycle position of the industry at the projected exit. In addition, National Oil Companies (NOC’s), manufacturing companies from developing nations and industry players looking to vertically integrate or broaden their product/service portfolio are also investing. Typical deal makers, brokers or advisors that are predominantly available are made up of bankers, investment bankers, financial analysts and lawyers with a modicum of industry familiarity with perhaps a few persons on the staff that have actually worked in the industry at one point in their career, usually not more than middle management levels.

M7 Advisors has been created to be an advisory service to these constituencies by offering a network of senior oil and gas executives from both US and multinational operating companies and service companies, US and international investment banking, banking and private equity investment experience. After studying investor objectives M7 veterans will be able to:

- Analyze business models, plans and aspirations, and highlight potential opportunities to accept or improve the investment.

- Advise on the potential dangers inherent in mismatched merger partners, complex or challenging technology requirements and success factors, geographical penetration strategies and misunderstood opportunities all of which have created loss of value in many, many deals made by small and large investors.

The energy industries are risky, cyclical and volatile. Geopolitical overtones trump market drivers of supply and demand routinely and without justification. Reading the implicit impact on the industry with a high degree of certainty comes from experience – both in having proven successes to having suffered setbacks – both invaluable learning experiences that need not be repeated. The M7 team of executives has done both and in most cases can elevate the chances of success and prevent the repetition of failure. Insight gained by their collective experience cannot be replaced by mere knowledge through association, education or occupying non-executive management positions alone.

The management of risk and reward is key to success in any enterprise. Experience brings common sense, cool assessment, and time learned advice. This feature of the M7 network will allow quick response to the clients needs, which is extremely important and will be our only focus. Investor client respect must be earned but senior executive credentials are critical resources that can make a difference in your deal.